Edited at 5:06pm on 3/22 to reflect the discovery that Eugene Horse Auction again edited the Terms page for several of their auctions back to the original terms that matched with the other auctions and their primary auction terms page after original publication. The owner of Eugene Horse Auction makes a statement to NW Horse Report following publication.

Junction City, Ore. – A horse and livestock auction house in Oregon was recently found to have assessed surcharge “fees” on debit and credit card transactions for buyers over years despite the practice being a violation of Visa & Mastercard Merchant Rules, as well as being illegal in some of the states the company allowed bidders from including California. The fees potentially amount to tens if not hundreds of thousands of dollars from consumers who made auction purchases.

The revelations were uncovered in the midst of recent scrutiny on social media involving the Rafter B Livestock, Inc. dba Eugene Livestock Auction and Eugene Horse Auction (ELA), and one of its frequent sellers, Roy Crosson of Oklahoma, over the auction sale of a horse with an undisclosed and life-threatening medical issue to a woman in California. NW Horse Report will have more details in a follow-up story about the horse.

Despite having generally positive experiences as a buyer in the past, Kandra Aguilar, the woman who purchased the horse at the center of the scrutiny had also realized the surcharge fees charged during the past sales of two horses in 2022 and the recent horse just over a week ago, were improper.

Aguilar then requested the fees charged to her Visa debit card– which according to receipts totaled $268.80– be refunded to her by ELA. Aguilar pointed ELA to both California law as well as rules for Visa merchants which prohibit the practice. The receipts also clearly stated it was a “surcharge”.

An official with ELA responded by saying “It is not a % surcharge, there is a 3% buyers fee which is waived when cash or business checks are used as payments.”

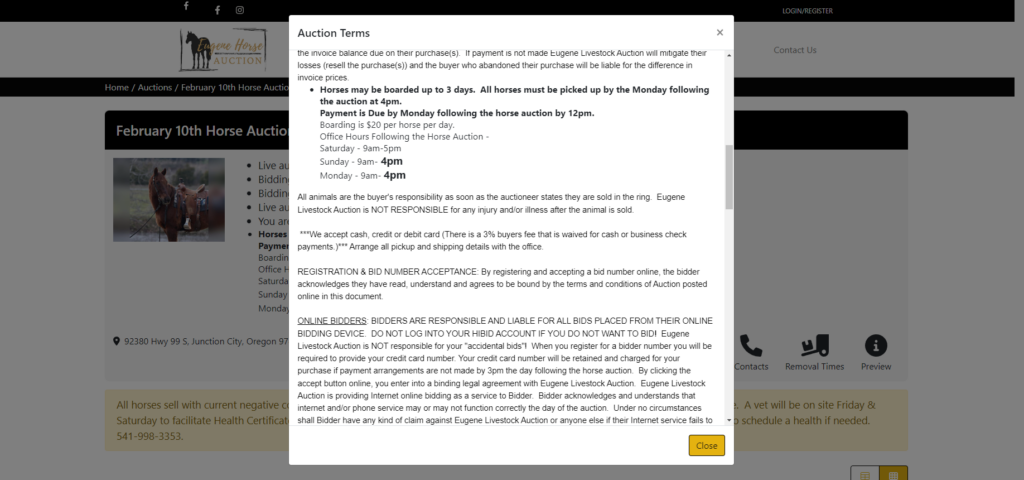

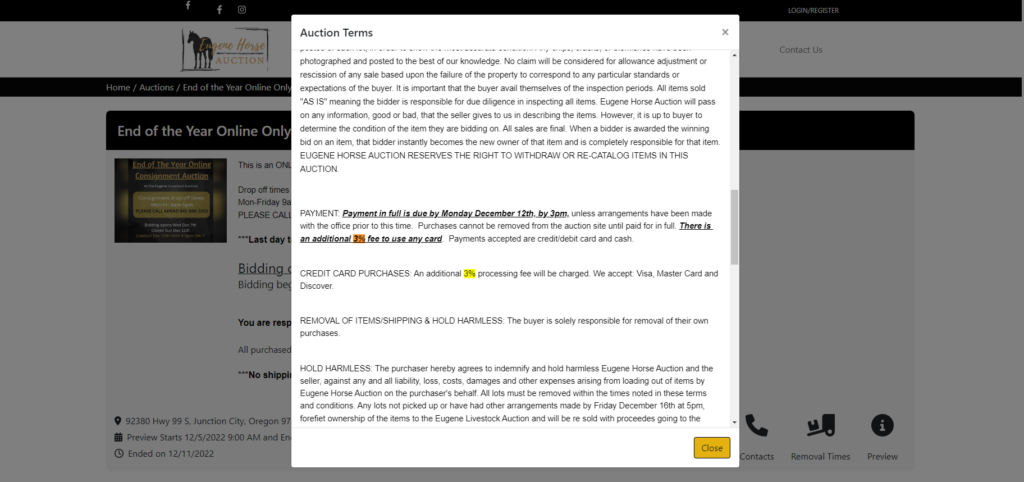

Following this email response to Aguilar, NW Horse Report noticed that the terms written on the two most recent auction ads were suddenly changed to the new language of “buyers fee” referenced in the email.

Prior to Aguilar’s request, NW Horse Report had already documented the original language after speaking with her and other former buyers which clearly references the “processing fee” and “surcharge”, confirming that ELA officials promptly edited the terms after Aguilar emailed them.

A link to the main Terms page was no longer on the ELA website, but by using a direct URL to the page NW Horse Report was able to find the original terms. As of the original publication, most of the past auction pages still showed the original language along with the main terms page, most of which have now been documented.

Aguilar also provided copies of her 2022 and recent 2023 receipts with ELA that also clearly indicated the 3% “surcharge”.

An attorney familiar with illegal surcharges and violations of the payment card network rules, who spoke only on the condition of anonymity, stated that the change in terminology is likely to still be viewed as semantics, explaining it was still a fee that is added and not a true “cash discount” from the actual price charged to the customer. It must be reflected as a discount, and simply removing a fee is not a discount.

The sudden website edits by ELA officials further raise serious questions on blatant efforts to cover up the improper fees that have been charged to consumers. The original language included, “We accept cash, credit or debit card (3% surcharge for debit or credit)” and “CREDIT CARD PURCHASES: An additional 3% processing fee will be charged for all card payments. We accept: Visa, Master Card and Discover.”

The original terms also stated in the “Payment” section, “There is an additional 3% fee to use any card. Payments accepted are credit/debit card and cash.”

NW Horse Report then discovered that following the original publication of this story on March 22nd, the three edited Terms pages for the last three auctions were then edited back to the original form. The edited “buyers fee” term language can still be seen in one of the above-included screenshots obtained by NW Horse Report.

According to Visa, “The ability to surcharge only applies to credit card purchases, and only under certain conditions. U.S. merchants cannot surcharge debit card or prepaid card purchases.”

A 2013 ruling as part of the Payment Card Interchange Fee Settlement allowed merchants to begin charging a surcharge where not prohibited by State law, but only with credit cards and not debit cards, and only in specific circumstances.

This included that merchants must first notify Visa or Mastercard and their acquirer of their intent to surcharge at least 30 days prior to implementing surcharging. Fees were also not allowed on debit cards even when “credit” was selected at a point-of-sale terminal.

The PCIFS ruling allowing merchants limited means to apply surcharges only on credit cards was almost entirely affirmed last week by the US Court of Appeals for the Second Circuit, but the affirmed ruling still had no impact on past and future transactions involving debit cards.

According to Mastercard, “For merchants who choose to impose a brand level surcharge [on credit cards], a merchant may only surcharge a Mastercard cardholder at the lesser of the merchant’s average effective merchant discount rate that the merchant pays its acquirer for Mastercard credit acceptance or the Maximum Surcharge Cap,”

That means that the surcharge could not exceed the percentage paid by the Merchant, and it’s possible that ELA’s acquirer rate is less than the 3% they are changing. The most common industry rate is 2.22% according to the Nilson Report.

It was not clear if ELA had made the application to Visa or Mastercard and their acquirer service, but had ELA made such an application, the fees charged to auction buyers using debit cards would still have been improper. A spokesperson with Mastercard spoke to NW Horse Report early Wednesday and was in the process of looking into the matter and following up with further comments.

If the company did not meet the requirements for credit card surcharges, then consumers who paid with a credit card could be in the same situation as those who paid with a debit card.

An office manager for ELA, who for the second time in several days informed NW Horse Report that they would pass our requests for comment on multiple matters to the owners, did promptly say when asked about the fees in violation of Visa, “we’re in compliance with the Visa & Mastercard services, we have someone who handles that.” said their office manager. They also referred to the surcharge as a “buyers fee”.

The office manager went on to explain that the “someone” was their payment processing service. However, simply using a payment processor (acquirer) does not inherently make such transactions compliant. The official at ELA promptly ended the call after the brief statement and NW Horse Report did not receive any return calls from the owners prior to press time.

ELA’s owners have not spoken on NW Horse Report for nearly a year after it was uncovered last year that a now former employee of ELA who was also the Vice President of the 501(c)(3) MG Equine Rescue, Tania Herring, was convicted of multiple counts of animal neglect. NW Horse Report had also recently uncovered that Herring was violating her probation by being in the care of about two dozen horses at a secret property outside Yakima, Washington. She is due back in court next month after having denied the State’s claim of the probation violation.

Herring reportedly received referrals as an independent contractor to conduct livestock transports for ELA, as well as working in an employee capacity as an “auction clerk”, all while she was forbidden under her court-issued release agreement from being in the possession of animals.

Hours after the original publication of this story, owner of the ELA Leon Birky returned calls from NW Horse Report seeking comment. Birky expressed his disagreement based on the basis that buyers had ultimately agreed to the terms.

In referring to this original story, Birky implied his attorney would also be contacting NW Horse Report and taking legal action, “By making that statement it’s defamation and libel.”

Birky went on to say, “I’m going to turn it over to my lawyer tomorrow and I’ll have him take care of it.”

“When they sign-up for a buyers number they need to read the terms and conditions, it specifically says in there they will be charged a 3% fee if they choose to use a credit card, so that’s why people get charged for that,” Birky also remarked.

Birky avoided the question when asked if he felt that allowed the company to circumvent the rules outlined by Visa & Mastercard that protect consumers, as well as California law prohibiting such charges when they conducted transactions with buyers in that state.

“I really don’t know about that,” said Birky.

While Birky also explained that he felt it was not specifically illegal in Oregon, he continued to avoid questions about the issue being a violation of the Visa & Mastercard rules to protect consumers. He also wouldn’t confirm if he had submitted the required application with Visa or Mastercard required to apply surcharges for credit card transactions.

Birky also wouldn’t respond when asked about Aguilar’s claims and the fact she used a Visa debit card which would not be exempted in either case, except to say she agreed to their terms.

While Oregon was not one of the states with a law that specifically makes surcharges illegal, the attorney who spoke to NW Horse Report further said that the practice could also be viewed as a violation of Oregon’s “Unfair Trade Practices Act”, as consumers would have a clear expectation as part of the payment card networks– like Visa and Mastercard– for merchants to follow the rules.

“Consumers absolutely have an expectation that the other members of the card networks, which includes merchants, are following the rules outlined for conducting transactions with and to protect consumers.” said the expert attorney.

“They have a duty to the consumer to follow the rules of the payment card network, even if the practice is not prohibited by law in their respective state.”

Another attorney who retired from practicing law in Oregon summarized in a 2016 article the following requirements related to surcharges:

- Inform Visa and MasterCard before you begin surcharging.

- Show the surcharge as a separate item on all transaction receipts.

- Display prominent signage at checkout advertising surcharge fees.

- Apply surcharges only to credit card purchases – you cannot legally add a surcharge to a pre-paid card or debit card (even if you run it as a credit card transaction).

- Limit surcharges to transactions in the domestic United States and US territories.

- Verify surcharges are not prohibited by law.

It appears that ELA also accepted Discover payments through its payment system, according to its own Terms.

The limits set out under the PCIFS are also separate from the Dodd-Frank Wall Street Reform and Consumer Protection Act which has also allowed merchants to impose a minimum of $10 on credit card transactions, but like the PCIFS it does not apply to debit cards.

According to the National Merchants Association which is an advocacy organization for merchants, “If you are one of the many merchants charging your patrons a surcharge for using a credit card, you may be exposing your business to hefty fines and penalties if you’re not following the appropriate guidelines.”

Many Oregon consumers may also recall the $66 Million class-action settlement against ARCO-AM/PM gas stations in 2014 for charging a surcharge on debit-card transactions for years.

In addition to being a violation of banking agreements and Visa & Mastercard merchant requirements, 10 states specifically make surcharging illegal, which likely apply to consumers in those states that the ELA permits to bid and pay remotely online. This includes California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma, and Texas.

A rules FAQ for Visa merchants can be located here: https://usa.visa.com/dam/VCOM/download/merchants/surcharging-faq-by-merchants.pdf

A copy of the original terms as of mid-day on March 22nd from the ELA website can be viewed by clicking here.

It is unclear how many consumers have attempted to contest the surcharges charged by ELA. The Eugene Horse Auction had also recently announced it would be shutting down its monthly operations after the April auction, but it is unlikely that decision is connected to this new discovery. It also did not appear to be a full closure of the entire Eugene Livestock Auction operation, just the monthly dedicated horse auction.

Consumers can also file reports with Visa related to improper surcharges online at: https://usa.visa.com/Forms/visa-rules.html

A direct online report form for Mastercard was not found.

This is a developing story that we will keep you updated on as we learn more.

You can always count on NW Horse Report to bring you the latest stories and investigations on matters related to consumer protection for equestrians. If you have a news tip be sure to email us at news@nwhorsereport.com or message us on Facebook.

Join the discussion on Facebook and Twitter.